NIN Is Now Your Tax ID: What Nigerians Need to Know About the New Tax Framework

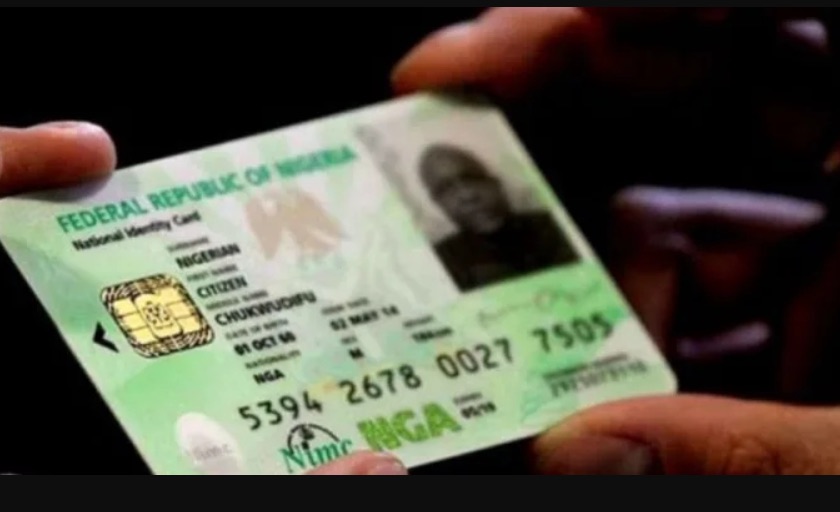

The Federal Inland Revenue Service (FIRS) has officially clarified that Nigeria’s National Identification Number (NIN) has automatically become the Tax Identification Number (Tax ID) for individual Nigerians under the country’s new tax framework.

This clarification was made through a public sensitisation video released by the FIRS to address growing concerns and confusion surrounding the implementation of new tax laws, especially claims that Nigerians would need to register afresh to obtain a Tax ID in order to operate bank accounts or carry out financial transactions.

Here is everything you need to know.

NIN Automatically Serves as Tax ID for Individuals

According to the FIRS, every Nigerian who has been issued a NIN now automatically has a Tax ID. There is no need to apply for a separate Tax Identification Number or obtain a physical card.

The Tax ID is simply a unique number digitally linked to an individual’s identity, and for individuals, that number is the NIN already issued by the National Identity Management Commission (NIMC).

This move unifies all previously issued Tax Identification Numbers by the FIRS and state internal revenue services into a single, nationwide identifier.

Businesses Will Use CAC Registration Numbers

For registered businesses, the reform also eliminates duplication. The FIRS clarified that companies will no longer need to obtain a separate Tax ID, as their Corporate Affairs Commission (CAC) registration number (RC number) will now automatically serve as their Tax ID under the new system.

This means both individuals and companies already possess valid Tax IDs without any additional registration.

No New Registration Required

One of the major public fears was that millions of Nigerians would be forced to undergo another round of registration from 2026 in order to keep their bank accounts active.

The FIRS has now confirmed that this will not be the case. Anyone who already has a NIN is considered to have met the Tax ID requirement. The reform simply links existing identity data to tax administration, making the process more efficient.

Why Tax ID Is Being Emphasised

The requirement for a Tax ID is anchored in the Nigeria Tax Administration Act (NTAA), which is scheduled to take effect from January 1, 2026.

However, the FIRS noted that the use of Tax ID for financial and economic transactions is not new. It has existed since the Finance Act of 2019, but the NTAA strengthens its enforcement to improve tax compliance and efficiency.

What the New System Aims to Achieve

According to the FIRS, the new Tax ID framework is designed to:

Simplify tax administration Eliminate multiple and duplicate tax identities Close loopholes that enable tax evasion Improve fairness in the tax system Ensure individuals and businesses earning taxable income contribute appropriately

With this arrangement, only Nigerians who earn taxable income are required to pay tax, even though everyone with a NIN automatically has a Tax ID.

ATTENTION: Follow 9jaReporters on Instagram for a chance to win ₦100,000 in our Top Fans Challenge!

JOIN NOW to participate and stand a chance to win exclusive prize ons, free airtime, and exciting gifts!

FOLLOW US TODAY! DON’T MISS OUT!

How Many Nigerians Are Covered?

Data from the National Identity Management Commission (NIMC) show that as of October 2025, about 123.9 million Nigerians have been issued a NIN.

This significantly expands the government’s capacity to streamline tax administration, widen the tax net responsibly, and improve compliance under the evolving tax system.

Bottom Line

Your NIN is now your Tax ID No new registration or physical Tax ID card is required Businesses will use their CAC registration numbers The policy takes stronger effect from January 1, 2026 Only those earning taxable income are required to pay tax

The reform is aimed at simplification, not punishment, and is intended to reduce stress for Nigerians while improving transparency and efficiency in the tax system.